30 year heloc payment calculator

Use Bankrates auto loan calculator to find out your payment on any car loan. This data is based on Housing Finance at a Glance.

Home Equity Line Of Credit Heloc Rocket Mortgage

N the total number of payments.

. How much money could you save. On the other hand if you want to reduce your principal faster you can go for an accelerated biweekly payment schedule. Say you finance 300000 at 3 for a 30 year rate.

For example on October 8 2020 the national average interest rate for a 30-year fixed rate mortgages was 287 percent while the average credit card interest rate on cards assessed interest stood at 1643 percent in August 2020. By default 250000 30-yr fixed-rate loans are displayed in the table below. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

At the same time the rate on a 20-year HELOC is 715 down 11 basis points. As for 30-year fixed-rate mortgages Urban Institute reported that it. PMI vs 2nd Mortgage.

Loan payment calculator. This is also calculated using the. Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period.

Fifth Third Bank has a good promotional APR for HELOCs starting at 299 for the first six months. The resulting number will be how much your interest payment for the month is. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage.

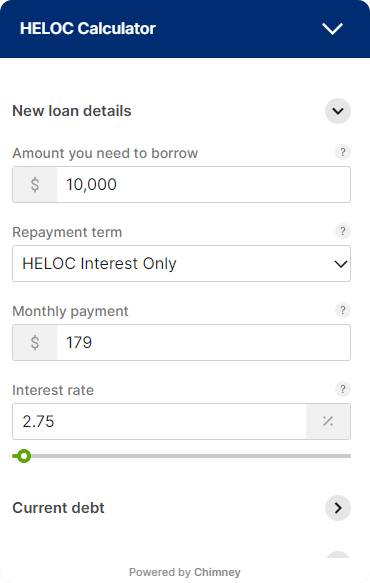

The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying. 435 Promotional Rate. A HELOC can help you to lower your debt payments by lowering your interest rate.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Home equity line of credit HELOC calculator. For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year.

Todays national 30-year mortgage rate trends. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. The best 30-year refinance deals go to borrowers with credit scores of 740 or higher.

With a standard 30 year conventional mortgage at a 3 APR you will still generally pay between 40-120 of the total price of the principal balance in interest to the bank. You would be eligible for a HELOC of up to 30. The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount that can be converted is limited to 90 of the maximum line amount.

Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. Seller Closing Cost Calculator. On Friday September 02 2022 the current average rate for the benchmark 30-year fixed mortgage is 595 rising 3 basis points over the last seven.

We offer a number of calculators that makes it easy to compare 2 terms side-by-side for all the common fixed-rate terms. Choosing to have routine monthly payments between 30 years or 15 years or other terms can be a very important decision because how long a debt obligation lasts can affect a persons long-term financial goals. A monthly payment is multiplied by 12 resulting in 360 payments.

If you prefer predictable steady monthly payments a 30-year fixed. 250 250 month. Lets suppose you made a 20 percent down payment and borrowed a 270000 loan.

The table below compares the interest rate APR monthly payment and total interest cost for 15 20 and 30-year fixed-rate mortgages. 10 or 15 10 or 20 10 or 30 15 or 20 15 or 30 20 or 30. 30-year mortgage rates.

Below is the formula used. The seller closing cost calculator is able to calculate the real estate commission title escrow transfer tax and closing costs as a percentage of your home sale price or as a dollar amount. The minimum loan term is 1 year and the maximum term will not exceed the account maturity date.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. Thinking of getting a 30-year variable rate loan with a 5-year introductory fixed rate. Best 5-Year Variable Mortgage Rates in Canada.

For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments. Use Bankrate to compare offers on 30-year refinances and find the best deal for you. The average household earned 84352 a year and spent 70258 a year according to the BLS survey.

If you are planning to sell your house use this home sale calculator to estimate the total costs and proceeds that you will receive for selling your house. HELOC Rate Your interest only payment is. And then thereafter the variable rate can range from 422 to 1115 depending on current prime.

It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. Filters enable you to change the loan amount duration or loan type. McBride sees the 30-year fixed-rate mortgage peaking in 2022 at 375 percent and finishing the year at 35 percent.

5YR Adjustable Rate Mortgage Calculator. At the bottom of each calculator is a button to create printable amortization schedules which enable you to see month-by-month information for each loan throughout. A 15-year fixed mortgage sits at 538 a 296 rise.

However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time. A Monthly Chartbook released in June 2020. HELOC Payment Calculator.

You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only monthly payments. 30-year mortgage rates. 30 Year Fixed.

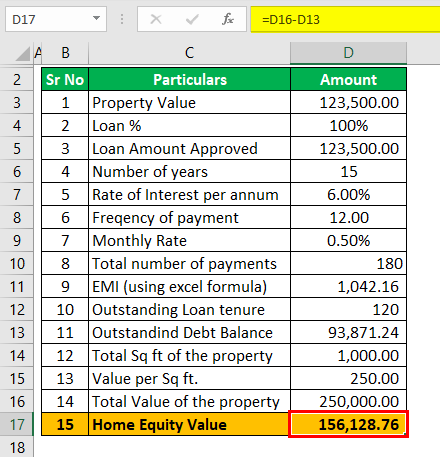

A Homeowners Guide to Understanding Home Equity Options One benefit of home ownership is the ability to use earned equity to borrow the money you need. Lock-in Redmonds Low 30-Year Mortgage Rates Today. Home Value x 80.

Use an auto loan calculator. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. Though lines of credit may have a.

Monthly Home Equity Loan Repayment Calculator

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com

Downloadable Free Mortgage Calculator Tool

Home Equity Loans Selco

Heloc Calculator How To Get To Your Payoff Date Youtube

Monthly Home Equity Loan Repayment Calculator

Downloadable Free Mortgage Calculator Tool

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Heloc Calculator Calculate Available Home Equity Wowa Ca

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Home Equity Line Of Credit Qualification Calculator

Heloc Calculator

Mortgage Payoff Calculator With Line Of Credit

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com